Alright, so let’s get started with our very first Monthly group coaching call. I’m extremely excited, and I hope you all are as well. Here’s what we have on the agenda for today’s call: a market overview for November, UI and DI entries, and tips on building a holistic portfolio. We’ll be discussing the recent performance of iwm, spy, and QQQ index ETFs, along with the reasons behind the market’s performance. Then we’ll delve into neutral iron condors and strangles for iwm, spy, and QQQ, as well as the concept of building a holistic portfolio using options for positive deltas, investing in fundamentally strong stocks, and considering T-bills for additional returns. We’ll also cover some key points on analyzing and rolling trades, limiting losses during market crashes, and the impact of asymmetrical wings on trading options. So without further ado, let’s dive right in! The OptionsWithDavis Nov 2023 Training Call is a monthly group coaching call held by Heating & Cooling Solutions. The agenda for this call includes a market overview for November, UI and DI entries, and how to build a holistic portfolio. Let’s dive into each topic to gain a better understanding.

Market Overview for November

In the market overview, we will discuss the recent performance of the iwm, spy, and QQQ index ETFs, as well as the reasons behind the market’s performance. It is important to stay informed about market trends and understand the factors that can influence the market. Recently, these index ETFs have been performing well, with iwm lagging behind due to factors such as the Silicon Valley Bank collapse and the composition of the index consisting of less profitable small-cap stocks. The market has been rallying, driven by positive inflation data and strong earnings from companies within the iwm, spy, and QQQ. However, it’s important to note that market conditions can change, and it’s best to base our trades on income criteria rather than speculating on market movements.

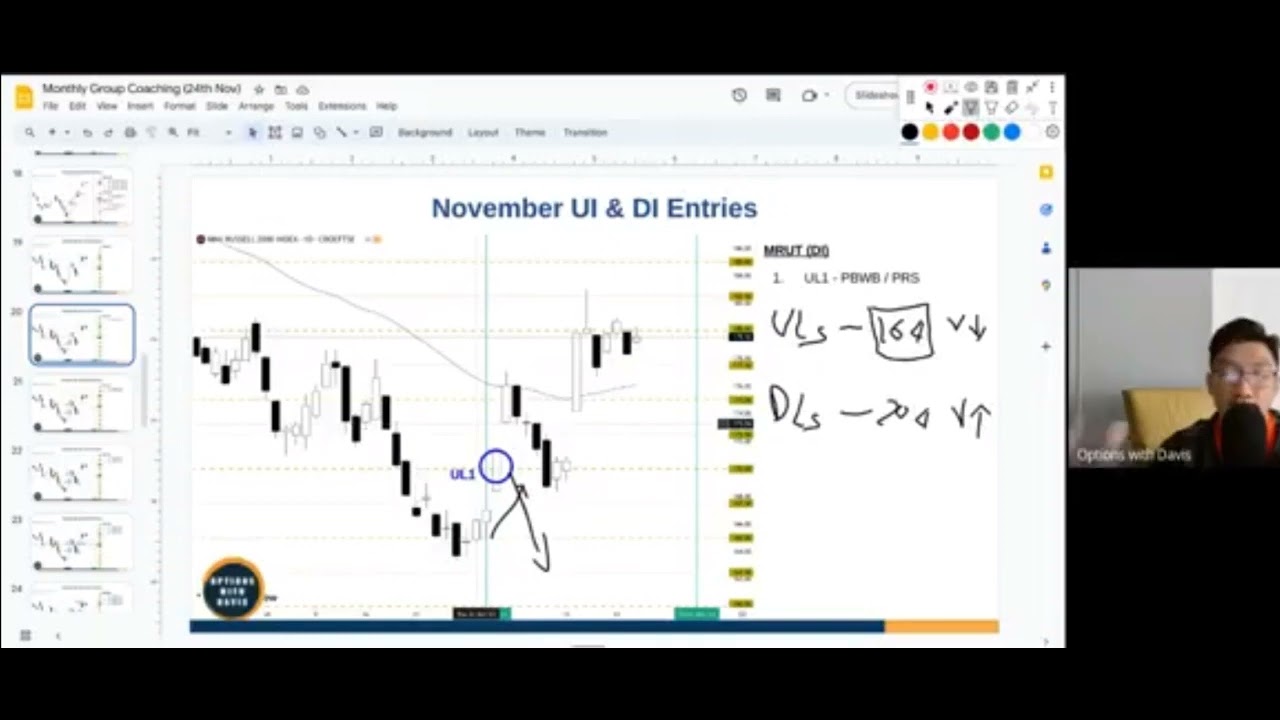

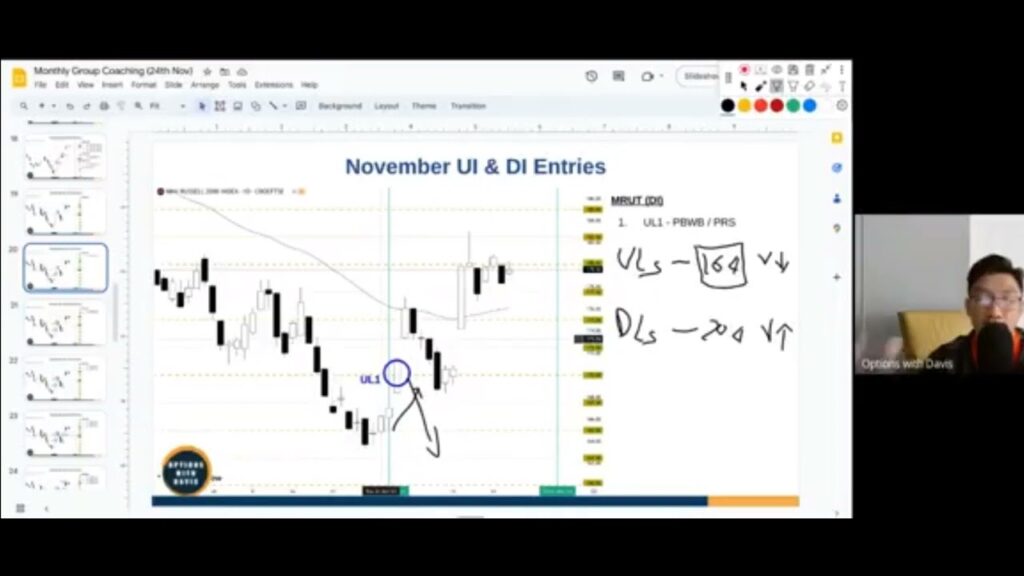

UI and DI Entries for November

Now, let’s discuss the UI and DI entries for November. For the iwm, spy, and QQQ, the recommended trades include neutral iron condors and strangles. These strategies help take advantage of the market’s neutral to slightly bullish expectations. By implementing these trades, you can potentially benefit from time decay and range-bound market conditions. The specific trades will depend on your account size and risk tolerance. It’s crucial to consider proper trade entry techniques, especially when the market opens at a different level than expected. Assess your existing positions and diversify them to avoid clustering your trades around the same position.

Building a Holistic Portfolio

Building a holistic portfolio involves using options for positive deltas, investing in fundamentally strong stocks, and considering T-bills for additional returns. By using options for positive deltas, you can participate in upward market movements while still managing risk. It’s also essential to invest in fundamentally strong stocks to have a solid foundation for your portfolio. Fundamental analysis can help you identify companies with strong financials and growth potential. Additionally, considering T-bills can provide additional returns and boost your base return. T-bills offer a low-risk opportunity for generating income and can provide additional buying power for your option trades.

Using T-Bills to Boost Returns

Using T-bills to boost returns involves understanding how they can provide additional income and buying power for your trades. T-bills are short-term government bonds that are considered safe investments, making them an attractive choice for generating additional income. By allocating a portion of your portfolio to T-bills, you can increase your overall return. Furthermore, the cash you receive from T-bills can be used as buying power for your option trades, allowing you to take advantage of more opportunities in the market.

Calculating Max Loss on Defined Risk Trades

When trading defined risk trades, such as iron condors, it’s important to calculate the maximum loss. The formula for calculating the max loss involves subtracting the premium received from the maximum spread width. It’s crucial to consider commissions in this calculation to get an accurate estimation of potential losses. By understanding the maximum loss, you can determine the risk associated with the trade and make informed decisions regarding position sizing and risk management.

Determining Max Risk on Iron Condors with Uneven Wings

Iron condors with uneven wings can offer different risk and potential return profiles. It’s important to understand the impact of uneven wings on the max risk of the trade. In general, the wider spread side of the iron condor will determine the max risk. By analyzing the potential risk and return of iron condors with uneven wings, you can make informed decisions about which trades to enter. It’s essential to consider your risk tolerance and adjust your strategies accordingly.

Trading Options with Asymmetrical Wings

When trading options, it’s not always necessary for both sides of the wings to be exactly the same. Asymmetrical wings on the options chain can be acceptable, as long as you understand the risk and potential return. It’s essential to have a balanced perspective when considering asymmetrical wings. By stretching one strike on the call side or increasing one strike on the put side, you can create asymmetrical wings. This can result in lower risk on the call side and provide flexibility in your trading strategies.

Analyzing and Rolling Trades

Analyzing and rolling trades is an important aspect of options trading. The example of rolling a put strike for additional credit demonstrates the potential benefits of this strategy. By rolling the put strike from 410 to 424, you can receive additional credit, which can enhance your overall position. Analyzing trades involves assessing the current market conditions, evaluating the profitability and risk of your positions, and making adjustments if necessary. Rolling trades can help manage risk and optimize your profitability.

Limiting Losses in Market Crashes

Limiting losses in the event of a market crash with high volatility is a priority for any options trader. While there are no strategies that work well in both normal market conditions and market crashes, certain techniques can help mitigate losses. The frequency of crashes that significantly affect trades is rare, but it’s important to be prepared. Strategies like the 50% take profit and 21 DTE can help limit losses during market crashes. It’s crucial to have a plan in place and to adjust your trading strategies accordingly when faced with heightened market volatility.

Iron Condors vs. Strangles during Market Crashes

During market crashes, iron condors tend to perform better compared to strangles. This is due to the defined risk nature of iron condors, which limits potential losses. Strangles, on the other hand, have undefined risk and can experience significant losses during market crashes. By choosing iron condors over strangles during market crashes, you can better manage your risk and potentially mitigate losses. It’s important to consider your risk tolerance and market conditions when deciding between these two strategies.

In conclusion, the OptionsWithDavis Nov 2023 Training Call provides valuable insights into options trading strategies. By understanding the market overview, UI and DI entries, building a holistic portfolio, and implementing risk management techniques, you can enhance your trading skills and increase your potential for success. Remember to always stay informed, analyze your trades, and adapt your strategies based on market conditions.