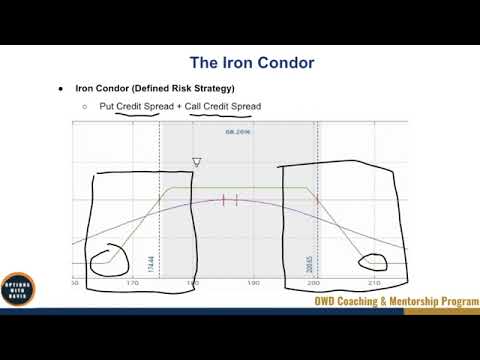

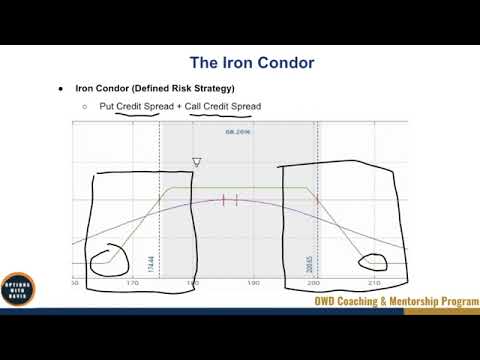

In the world of options trading, the iron condor strategy is a powerful tool to consider. It offers a defined risk approach, meaning you know the maximum risk upfront. The strategy combines a put credit spread, also known as a bull put spread, and a call credit spread, also known as a bear call spread. There are three types of iron condors: neutral, bullish, and bearish. The neutral iron condor involves short strikes at 16 to 20 delta and a width of $10, with the premium being around 20% of the width. The preferred exit is at around 21 days to expiration or at a profit of 30% to 50%. The bullish iron condor pushes the short put strike closer to the current market price and the short call strike further away, while the bearish iron condor does the opposite, pushing the short put strike further away and the short call strike closer to the current market price. Adjustments can be made based on your level of bullishness or bearishness.

Alright, now let’s dig into the details of the iron condor strategy. This defined risk strategy is a combination of a put credit spread and a call credit spread, providing you with a maximum risk known upfront. There are three types of iron condors: neutral, bullish, and bearish. The neutral iron condor follows specific guidelines, such as having short strikes at 16 to 20 delta and a width of $10, with the premium around 20% of the width. For the preferred exit, you can consider around 21 days to expiration or a profit of 30% to 50%. The bullish iron condor adjusts the short put strike closer to the current market price and the short call strike further away, while the bearish iron condor does the opposite. Keep in mind that adjustments can be made to align with your level of bullishness or bearishness.

Types of Iron Condors

Neutral Iron Condor

A neutral iron condor is a strategy that is used when the market is anticipated to stay within a relatively tight range. It combines a put credit spread and a call credit spread to create a defined risk strategy. In this type of iron condor, the short strikes are typically set at a delta of 16 to 20. The width of the iron condor is usually around $10. The premium collected from this strategy should be around 20% of the width. Additionally, the preferred exit for a neutral iron condor is at around 21 days to expiration or at a profit of 30% to 50%.

Bullish Iron Condor

A bullish iron condor is employed when there is a belief that the market will move upwards. In this strategy, the short put strike is pushed closer to the current market price, typically between 25 to 40 deltas. On the other hand, the short call strike is pushed further away from the market, usually at 10 to 20 deltas. The width, premium, and preferred exit for a bullish iron condor follow the same guidelines as a neutral iron condor.

Bearish Iron Condor

A bearish iron condor is used when the market is expected to move downwards. The short put strike is set at 10 to 20 deltas, while the short call strike is at 25 to 40 deltas. Like the other types of iron condors, the width, premium, and preferred exit for a bearish iron condor remain consistent with the guidelines for a neutral iron condor.

Guidelines for a Neutral Iron Condor

Short Strikes

In a neutral iron condor, the short strikes should be set at 16 to 20 deltas. This means that the strikes are slightly out of the money, providing a higher probability of success.

Width

The width of a neutral iron condor is typically around $10. This means that the distance between the short put strike and the short call strike is $10.

Premium

The premium collected from a neutral iron condor should be around 20% of the width. This ensures that the risk-reward ratio is balanced.

Preferred Exit

The preferred exit for a neutral iron condor is generally at around 21 days to expiration or at a profit of 30% to 50%. Exiting at this point helps to manage risk and capture profits.

Adjustments for Neutral Iron Condor

Higher Bullishness

If the market starts to exhibit more bullishness, adjustments can be made to the neutral iron condor. For example, the short put strike can be pushed closer to the current market price. This allows for potential profit if the market continues to move upwards.

Higher Bearishness

Conversely, if the market becomes more bearish, adjustments can be made by pushing the short call strike closer to the current market price. This allows for potential profit if the market continues to move downwards.

Guidelines for a Bullish Iron Condor

Short Put Strike

In a bullish iron condor, the short put strike is set at a delta of 25 to 40. This means that the strike is slightly closer to the current market price compared to a neutral iron condor.

Short Call Strike

The short call strike in a bullish iron condor is set at a delta of 10 to 20. This provides a wider range for potential profit if the market moves upwards.

Adjustments for Bullish Iron Condor

Pushing Short Put Strike

If the market becomes even more bullish, adjustments can be made by pushing the short put strike even closer to the current market price. This allows for potential profit if the bullish trend continues.

Pushing Short Call Strike

In the event of increased bullishness, the short call strike can be pushed further away from the current market price. This provides a wider range for potential profit if the market continues to move upwards.

Guidelines for a Bearish Iron Condor

Short Put Strike

The short put strike in a bearish iron condor is set at 10 to 20 deltas. This strike is slightly out of the money, providing a higher probability of success if the market moves downwards.

Short Call Strike

In a bearish iron condor, the short call strike is set at 25 to 40 deltas. This means that the strike is slightly closer to the current market price compared to a neutral iron condor.

Adjustments for Bearish Iron Condor

Pushing Short Put Strike

If the market becomes even more bearish, adjustments can be made by pushing the short put strike further away from the current market price. This allows for potential profit if the bearish trend continues.

Pushing Short Call Strike

In the event of increased bearishness, the short call strike can be pushed closer to the current market price. This provides a wider range for potential profit if the market continues to move downwards.

Conclusion

The iron condor strategy provides investors with a defined risk approach to trading. By understanding the different types of iron condors and the guidelines and adjustments for each, investors can effectively manage their trades in various market conditions. Whether employing a neutral, bullish or bearish iron condor, it is important to adhere to the suggested guidelines for short strikes, width, premium, and preferred exit strategies. Making necessary adjustments based on market trends can further optimize potential profit. Overall, iron condors offer a flexible strategy that allows investors to capitalize on market movements while limiting risk.