Okay, so let’s dive deeper into the concept of losing streaks in trading strategies. Losing streaks refer to consecutive losses that can happen when you’re trading. In this video, we’ll discuss probability tables that help traders understand the likelihood of experiencing losing streaks. Different trading strategies have different win rates and probabilities of consecutive losses. It’s important to emphasize the role of psychology in trading and not giving up during losing streaks. The video also provides a 100-trade sample with statistics on win rates, average wins, average losses, and longest losing streaks for certain trading strategies. The main takeaway is to focus on the long-term and not get discouraged by short-term losing streaks.

Understanding Losing Streaks

Losing streaks are an inevitable part of trading strategies. They refer to consecutive losses that traders can experience while implementing their trading strategies. While losing streaks can be frustrating, it is crucial to understand the concept of consecutive losses and the factors that influence them. By understanding losing streaks, traders can better manage their expectations and develop strategies to cope with these downturns.

Definition of Losing Streaks

In the context of trading, a losing streak occurs when a trader experiences a series of consecutive losses in their trades. These streaks can span over a specific number of trades or a specific time period. Understanding losing streaks involves analyzing the number of consecutive losses a trader can expect when implementing their trading strategy.

The Concept of Consecutive Losses

Consecutive losses refer to a series of trades that result in losses without any profitable trades in between. This concept is crucial in understanding the impact of losing streaks on a trading strategy. Traders need to consider the probability of consecutive losses when developing their strategies and managing their risk.

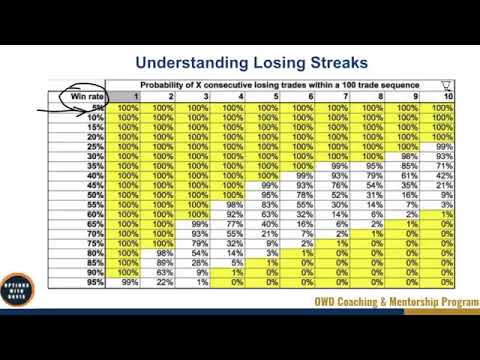

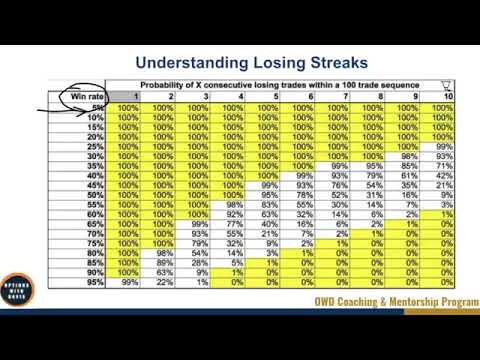

Importance of Probability Tables

Probability tables play a significant role in understanding the likelihood of experiencing losing streaks. These tables provide traders with valuable insights into the probability of consecutive losing trades over a certain number of trades. By referring to probability tables, traders can gain a better understanding of the potential losing streaks they might encounter and manage their expectations accordingly.

Factors Affecting Losing Streaks

Several factors can influence losing streaks in trading strategies. Market volatility, trading strategy, and risk management techniques are among the key factors that impact consecutive losses. Traders need to consider these factors when developing their trading strategies to mitigate the impact of losing streaks and minimize potential losses.

Different Win Rates for Trading Strategies

Different trading strategies have varying win rates, which directly affect the probability of experiencing consecutive losses. Understanding win rates is crucial in evaluating the effectiveness and potential profitability of a trading strategy. Factors such as market conditions, trading style, and the underlying asset can influence win rates.

Probability of Consecutive Losses

Determining the probability of consecutive losses is essential for traders to assess the potential risk associated with their trading strategies. Probability calculations can be derived from probability tables or statistical analysis. By understanding the probability of consecutive losses, traders can make informed decisions and adjust their strategies accordingly.

Psychological Impact of Losing Streaks

Losing streaks can have a significant psychological impact on traders. The emotional toll of consecutive losses can lead to frustration, self-doubt, and impulsivity in decision-making. Maintaining a positive mindset and developing strategies for coping with losing streaks are crucial for long-term success in trading.

Statistics on Win Rates and Average Wins

Analyzing win rates and average wins can provide valuable insights into the performance of trading strategies. Traders can evaluate the effectiveness of their strategies by examining the win rates and average wins achieved over a certain number of trades. These statistics offer a clear picture of the potential profitability and risk associated with a particular trading strategy.

Statistics on Average Losses and Longest Losing Streaks

Understanding average losses and the longest losing streaks can help traders evaluate the potential downside risk of their strategies. By analyzing these statistics, traders can identify the maximum loss they may face during a losing streak and adjust their risk management techniques accordingly. This information is crucial in maintaining a balanced approach to trading and avoiding detrimental losses.

Maintaining Focus on the Long-Term

Traders must maintain a long-term perspective when dealing with losing streaks. Short-term downturns are a normal part of trading, and focusing on the bigger picture can help traders stay motivated and avoid making impulsive decisions. Setting realistic expectations and developing strategies for bouncing back from losing streaks are essential aspects of long-term success in trading.

Understanding losing streaks is vital for traders to navigate the ups and downs of the market confidently. By defining losing streaks, analyzing consecutive losses, considering probability tables, and accounting for various factors influencing losing streaks, traders can develop effective strategies and maintain a positive mindset in the face of challenging periods. By focusing on the long-term and staying resilient, traders can achieve consistent profitability in their trading endeavors.