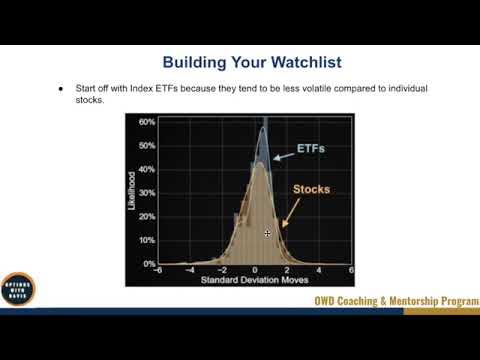

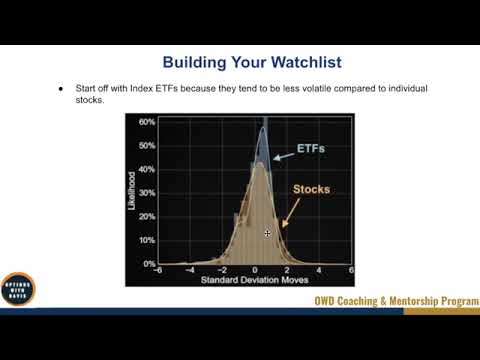

In the video “4-2 Building Your Watchlist,” we will discuss the importance of building a watchlist when trading stocks. It is recommended to start with index ETFs as they tend to be less volatile than individual stocks. The analysis by the Tasty Trade team shows that index ETFs have smaller price ranges compared to stocks, making them a desirable choice. Stocks can be affected by earnings and individual news, leading to larger price moves. On the other hand, ETFs are a basket of stocks, resulting in more controlled price movements. You should look for liquid index ETFs with weekly options and tight bid/ask spreads. The main underlyings for trading are IWM, SPY, QQQ, MRO, and XSP. It is advisable to avoid leverage ETFs due to increased risk and daily reset feature. If you are considering trading individual stocks, make sure to conduct your own research and due diligence. Building a watchlist by scanning for price extremes in individual stocks can help you identify potential trading opportunities.

Building Your Watchlist

Building a watchlist is an essential step when trading stocks. It allows you to keep track of specific stocks or ETFs that meet your trading criteria and can potentially provide profitable opportunities. By creating a watchlist, you can stay organized, focus on specific securities, and make informed trading decisions. In this article, we will discuss the importance of building a watchlist and provide guidance on how to create and manage an effective watchlist.

Importance of Building a Watchlist

Building a watchlist is crucial for traders as it helps them stay organized and prepared. With thousands of stocks and ETFs available for trading, it can be overwhelming to keep track of all potential opportunities. A watchlist allows you to narrow down your focus to a selected group of securities that align with your trading strategy and criteria.

By having a watchlist, you can monitor and study the price movements, trends, and news related to the securities on your list. This allows you to be well-informed and ready to take action when an opportunity arises. Without a watchlist, you may miss out on potential trades or waste time analyzing irrelevant stocks or ETFs.

Starting with Index ETFs

When building your watchlist, it is recommended to start with index ETFs (Exchange-Traded Funds). Index ETFs track specific market indexes, such as the S&P 500, Dow Jones Industrial Average, or Nasdaq Composite. These ETFs are a collection of stocks that represent the overall performance of the market or a specific sector.

Index ETFs are considered less volatile compared to individual stocks. They tend to have smaller price ranges, which can be beneficial for traders using certain strategies. The Tasty Trade team analysis shows that index ETFs have a tendency to stay within a narrow range compared to stocks.

Advantages of Index ETFs

There are several advantages to including index ETFs in your watchlist. Firstly, they provide exposure to a diversified set of stocks, reducing the impact of individual company news or events on the price movement. This can result in more controlled and predictable price movements.

Secondly, index ETFs tend to have high trading volumes and tight bid/ask spreads. This means that they are highly liquid and can be easily bought or sold at a fair price. Liquidity is crucial for traders as it ensures that there is enough trading activity to execute orders without significant price impact.

Thirdly, index ETFs often have weekly options available for trading. Weekly options have shorter expiration dates, providing more frequent trading opportunities. This can be advantageous for traders who prefer shorter-term strategies.

Considerations for Index ETFs

While index ETFs have their advantages, there are a few considerations to keep in mind when including them in your watchlist. Firstly, it is essential to choose liquid index ETFs with a significant trading volume. This ensures that there is enough liquidity to enter and exit trades without significant slippage.

Additionally, it is recommended to focus on index ETFs with tight bid/ask spreads. A tight spread indicates that there is a small difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask). Tight spreads make it easier to get in and out of trades at favorable prices.

Some popular and liquid index ETFs to consider for your watchlist include IWM (Russell 2000), SPY (S&P 500), QQQ (Nasdaq 100), MRO (Energy Select Sector SPDR), and XSP (S&P 500 Mini).

Liquid Index ETFs to Look for

When constructing your watchlist, it is important to ensure that the index ETFs or stocks you choose to include are liquid. Liquidity refers to the ability to buy or sell an asset without causing significant price movement.

One way to assess liquidity is by looking at the option chain of the ETF or stock. If there are weekly options available, it is an indication of higher liquidity. Weekly options have shorter expiration dates and are more actively traded, indicating that there is demand for the security.

Another factor to consider when evaluating liquidity is the tightness of the bid/ask spreads. The bid/ask spread is the difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask). A tight bid/ask spread indicates that there is a small difference between these prices, making it easier to enter or exit trades at favorable prices.

It is important to choose index ETFs with high liquidity, weekly options, and tight bid/ask spreads to ensure smooth execution of trades. This enhances the overall trading experience and reduces the risk of significant price slippage.

Main Underlyings for Trading

The main underlyings that traders often focus on include IWM, SPY, QQQ, MRO, and XSP. IWM represents the Russell 2000 index, which consists of small-cap stocks. SPY tracks the performance of the S&P 500 index, which includes large-cap U.S. stocks. QQQ follows the Nasdaq 100 index, which includes 100 of the largest non-financial companies listed on the Nasdaq stock market.

MRO represents the Energy Select Sector SPDR, which provides exposure to the energy sector. XSP is the S&P 500 Mini, which offers exposure to the S&P 500 index in a smaller contract size. These underlyings cover a range of sectors and market capitalizations, providing diversification and trading opportunities.

When choosing the main underlyings for your watchlist, it is important to consider factors such as their historical price volatility, liquidity, and options availability. Each underlying may have unique characteristics and suitability for different trading strategies. It is essential to perform thorough research and analysis to determine which underlyings are the most suitable for your trading style and objectives.

Avoiding Leverage ETFs

When building your watchlist, it is advised to avoid trading leverage ETFs. Leverage ETFs aim to deliver multiples of the daily returns of an underlying index or benchmark. While these ETFs can provide higher potential returns, they also carry higher risk.

Leverage ETFs use derivatives and other financial instruments to achieve their objective, which can lead to increased price volatility. Additionally, leverage ETFs have a daily reset feature, which means that their performance is reset daily and may not match the performance of the underlying index over longer periods.

Due to their amplified price movements and daily reset feature, leverage ETFs are not suitable for all traders, especially those with a lower risk tolerance. It is generally recommended to stick to non-leveraged index ETFs or individual stocks when constructing your watchlist.

Trading Individual Stocks

While index ETFs offer stability and controlled price movements, trading individual stocks can provide opportunities for greater returns. Individual stocks are influenced by company-specific news, earnings reports, and industry developments. These factors can cause significant price movements in individual stocks, presenting both risks and rewards for traders.

When trading individual stocks, it is critical to conduct thorough research and due diligence. Factors to consider include the company’s financial health, competitive positioning, industry trends, and catalysts that may impact the stock’s price. By understanding the fundamentals and technicals of individual stocks, you can make more informed trading decisions.

Price Extremes for Individual Stocks

One strategy for trading individual stocks is to focus on price extremes. This involves identifying stocks that have reached extreme levels of overvaluation or undervaluation. By targeting stocks at these extremes, there is a potential for mean reversion, where the stock’s price moves back towards its average or fair value.

Extreme levels can be identified using technical indicators, such as support and resistance levels, moving averages, or oscillators like the Relative Strength Index (RSI). When a stock reaches an extreme level, traders can look for confirmation signals to enter trades in the opposite direction.

Trading price extremes in individual stocks requires discipline and patience. It is crucial to wait for confirmation before taking a position and to manage risk carefully. By focusing on stocks with significant price deviations, traders can potentially capitalize on short-term price reversals.

Suggestions for Individual Stocks

When selecting individual stocks for your watchlist, it is important to conduct your own research and due diligence. Consider factors such as the company’s financials, industry outlook, competitive landscape, and recent news or events. This will help you assess the potential risks and rewards of trading a particular stock.

It can also be helpful to follow reputable financial news sources and listen to expert opinions to gain more insights into specific stocks. However, it is essential to make your own judgments and not solely rely on external opinions. Ultimately, you are responsible for your trading decisions and should have a thorough understanding of the stocks on your watchlist.

Building a Watchlist with dl5 and ul5 Levels

To build an effective watchlist, it can be beneficial to incorporate the concept of dl5 and ul5 levels. dl5 refers to a price level that is five points below the current price, while ul5 refers to a price level that is five points above the current price.

By scanning for stocks that have reached dl5 or ul5 levels, you can identify potential trade opportunities. dl5 levels may indicate oversold conditions, while ul5 levels may suggest overbought conditions. These levels can be used as signals for potential price reversals or continuation patterns.

By including dl5 and ul5 levels in your watchlist criteria, you can focus on stocks that have significant price movements and potential trading opportunities. However, it is crucial to use additional technical analysis tools and indicators to confirm these levels and make informed trading decisions.

In conclusion, building a watchlist is an important step for traders to stay organized and prepared. Starting with index ETFs can provide stability and controlled price movements, while individual stocks offer the potential for greater returns but carry additional risks. By considering factors such as liquidity, bid/ask spreads, and options availability, you can construct a watchlist that meets your trading needs. Incorporating dl5 and ul5 levels can help identify potential trading opportunities. Remember to conduct thorough research and due diligence when selecting securities for your watchlist and make informed trading decisions based on your own analysis and risk tolerance.